Summary

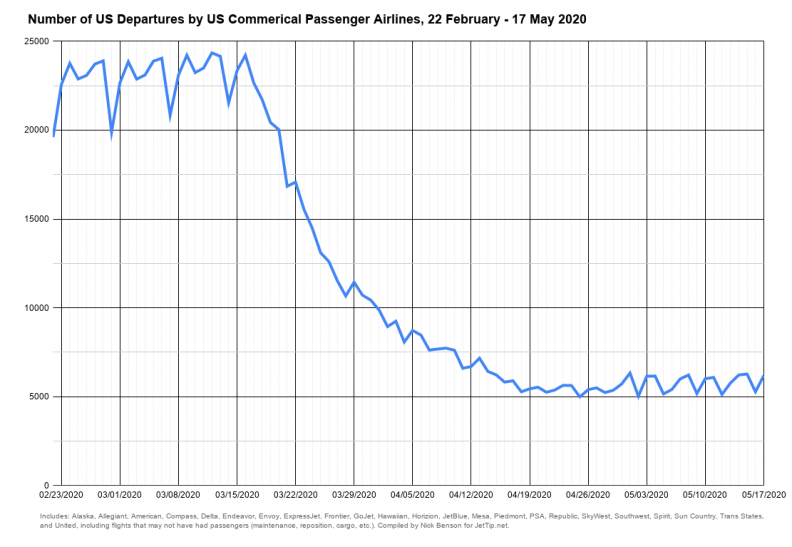

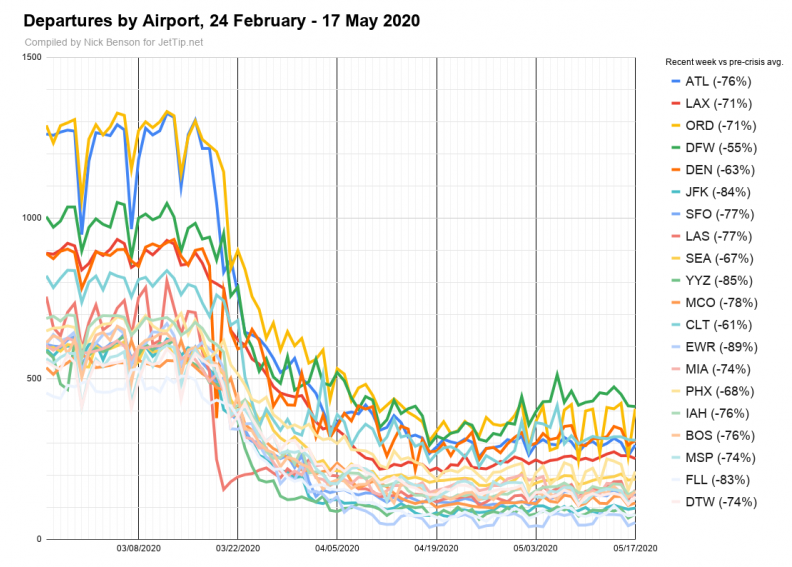

If you don't feel like scrolling through all of the graphs I've painstakingly created, the upshot is that passenger traffic here in the US is trending upwards, but we've got a long way to go. Here in the States, compared to pre-crisis stats, last week the airlines flew 51% of the aircraft in their fleets, operated 25% of the flights, and carried 9% of the passengers. Steadily increasing passenger screenings relative to fairly stable flight volumes mean the airlines are losing less money on each flight as time goes on. Lipstick on a pig, sure, but good news nonetheless.

Next Trip Appearance

Yesterday evening I recorded an appearance on The Next Trip Podcast, where I discussed many of these numbers - give it a listen via the embedded link below, or find it on your favorite podcast machine.

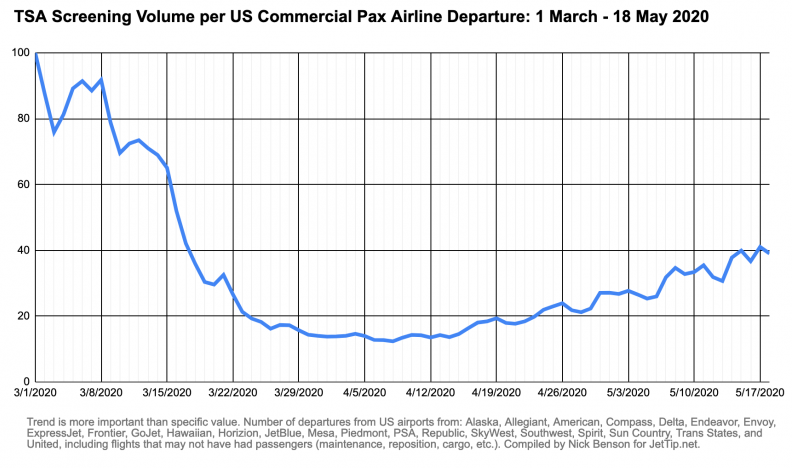

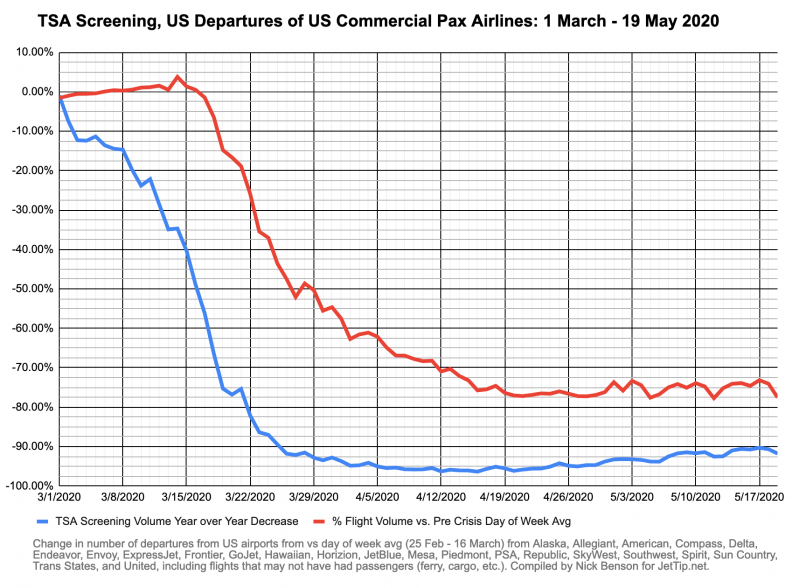

TSA Screening Volumes

Making graphs of TSA screening volume is very trendy in the avgeek analytics scene right now; my value-add is taking departures into account to see how the airlines are responding. Again, very promising upward trends with respect to passenger volumes and inferred load factors over the last couple of weeks.

Note: the TSA screening volume YoY percent change was erroneously plotted on account of account of spreadsheet error I made, which used the 12 May 2019 comparable volumes to tabulate YoY change instead of the values for the most recent days; as a result, the plotted value for 13 May 2020 to 18 May 2020 was 0-4% too high; the error has now been corrected. Note TSA YoY volume has not exceeded -90%, yet.

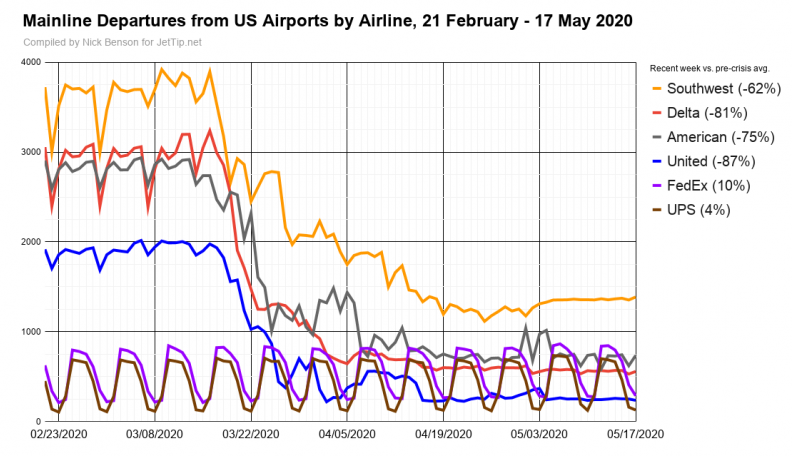

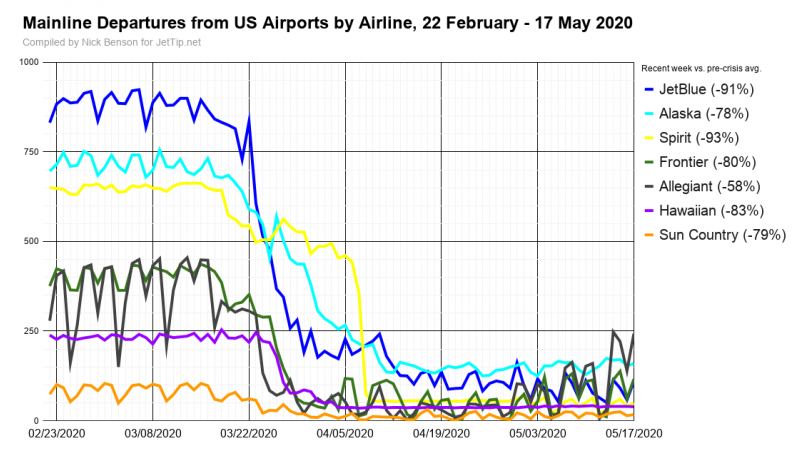

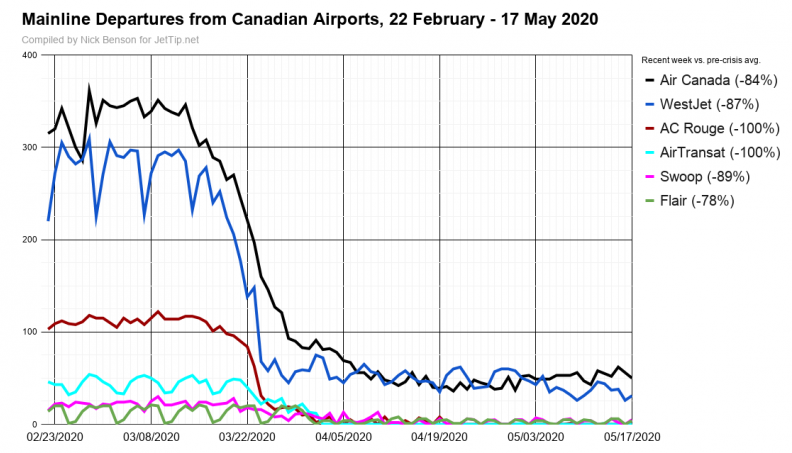

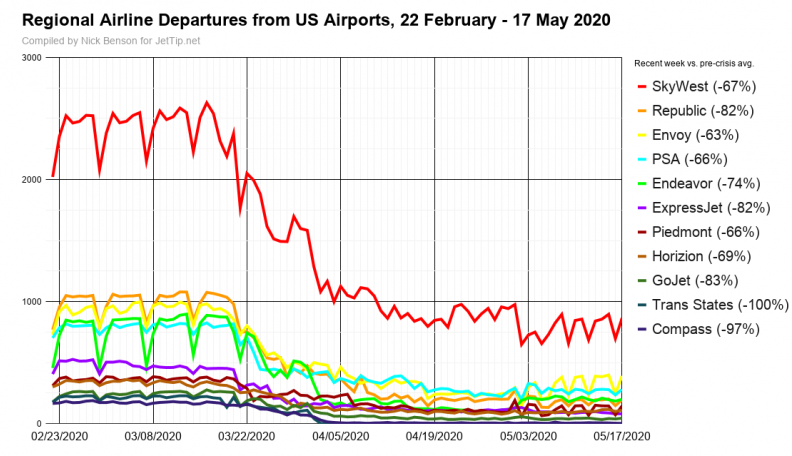

Airline Traffic Volumes

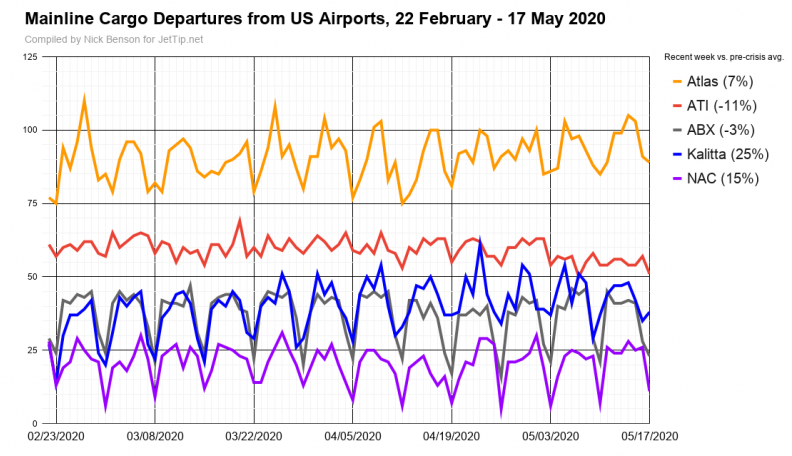

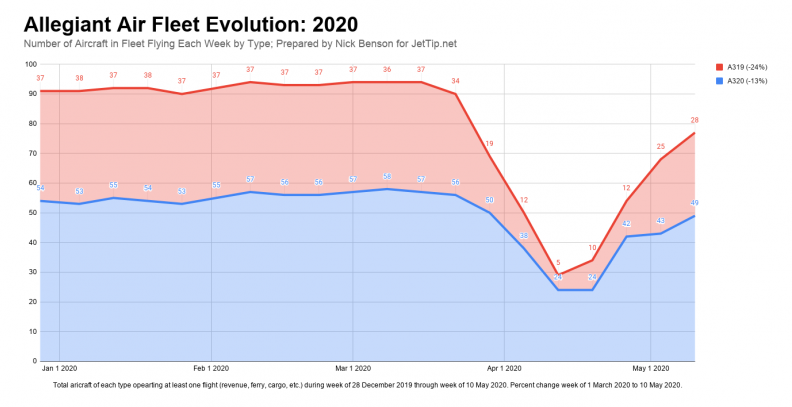

The airlines have largely found their post-crisis grooves with respect to flight volumes, pretty steady numbers across the board. Allegiant and Enovoy are outliers, both have increased their operations this month, not sure what the story is there, but might be worth looking into. FedEx and UPS are still up since COVID-19 hit, but their flight volumes decreased slightly last week.

For the first time in a long while, none of the major airports tracked hit post-crisis lows this Saturday, though Delta and ExpressJet did, but just barely.

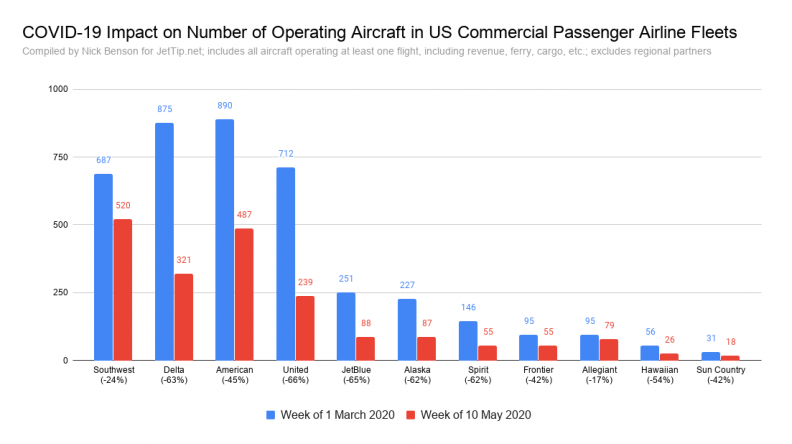

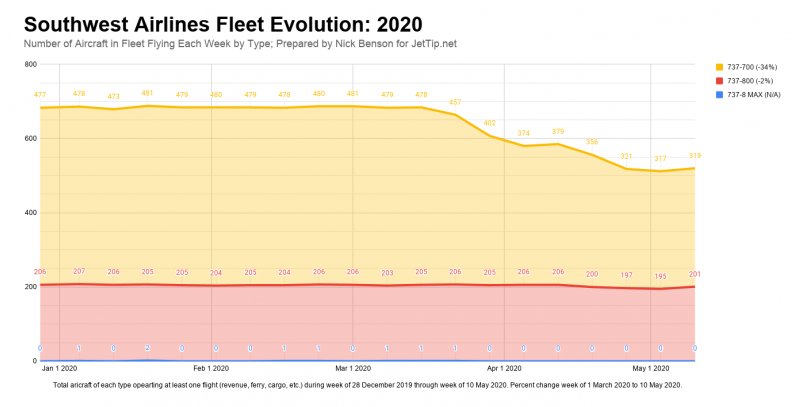

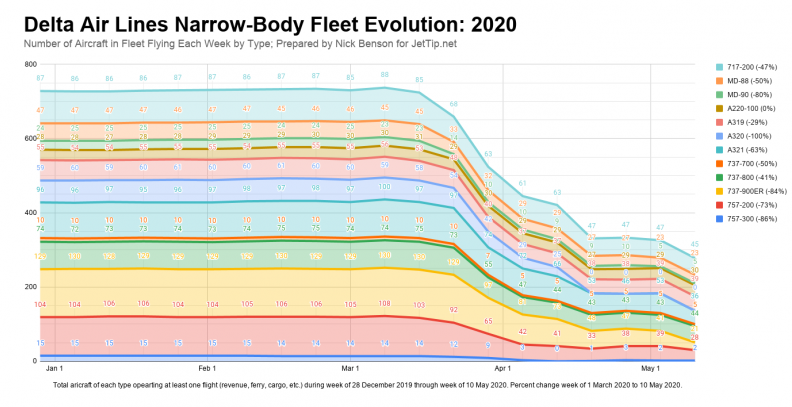

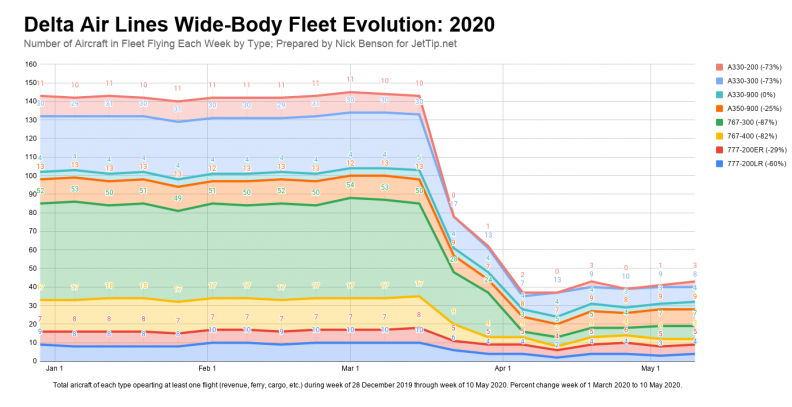

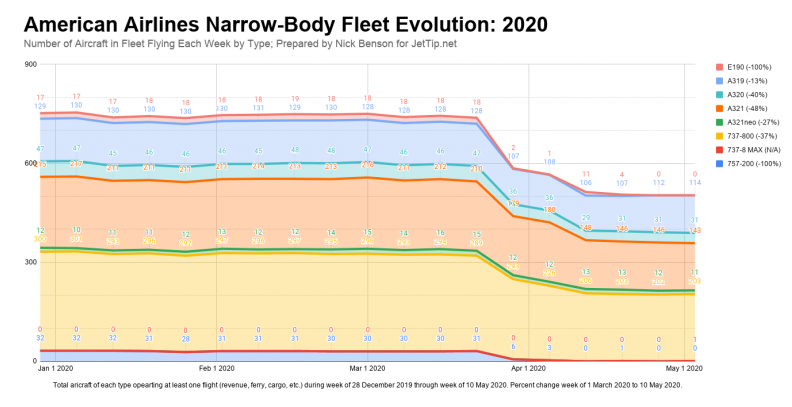

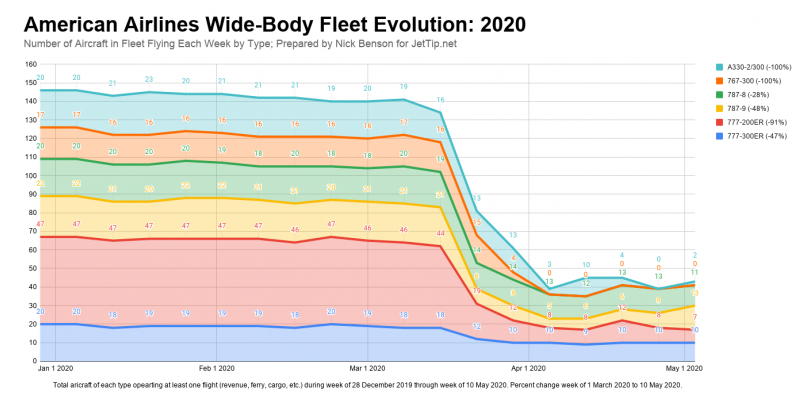

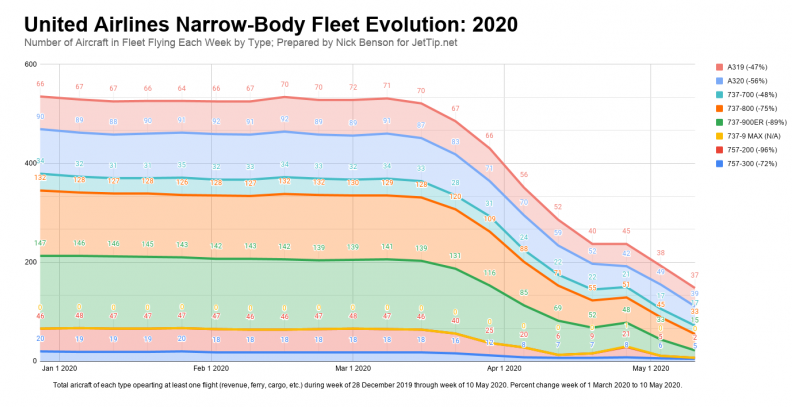

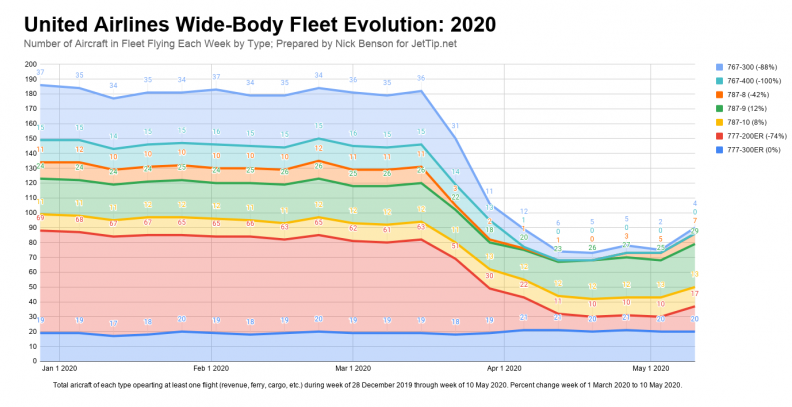

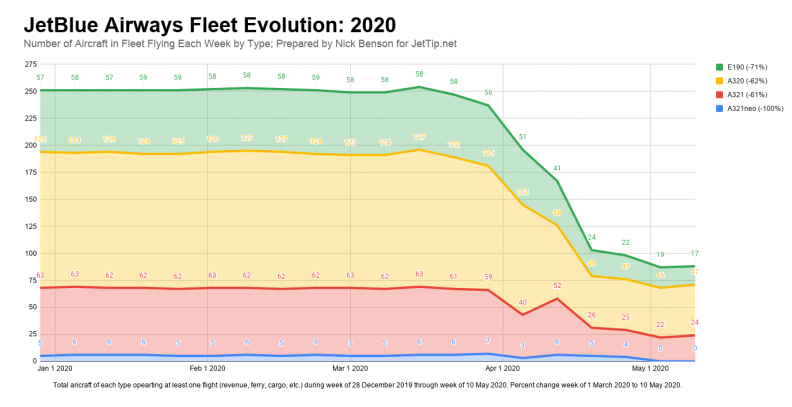

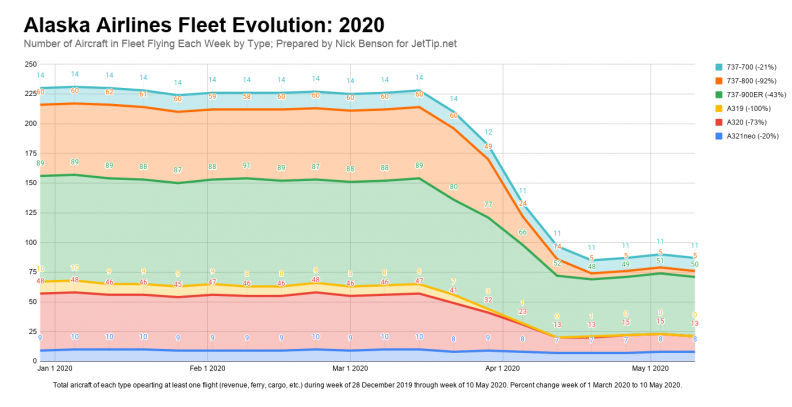

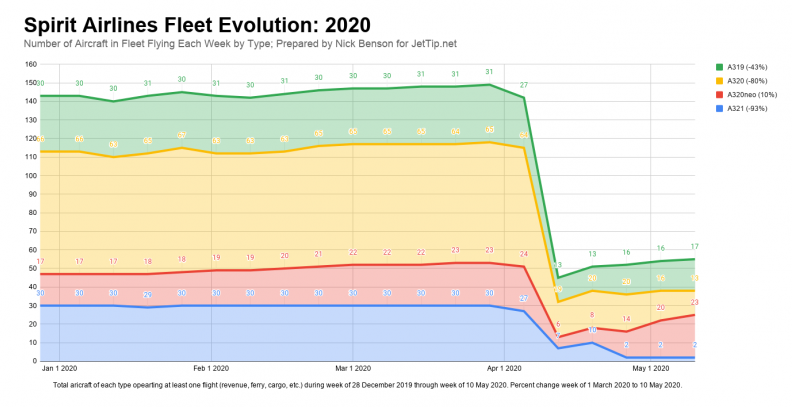

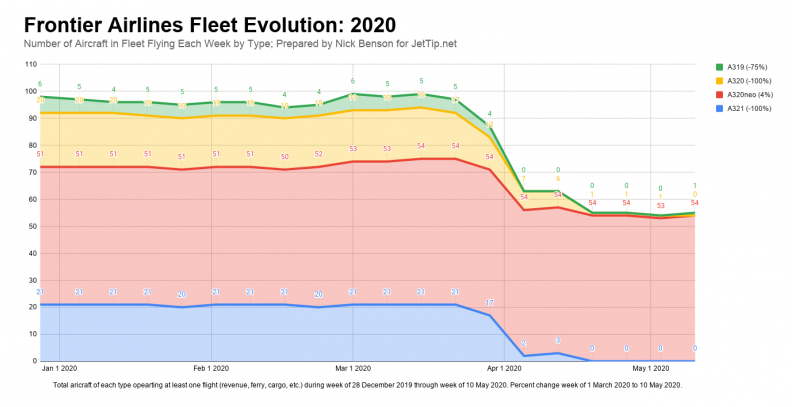

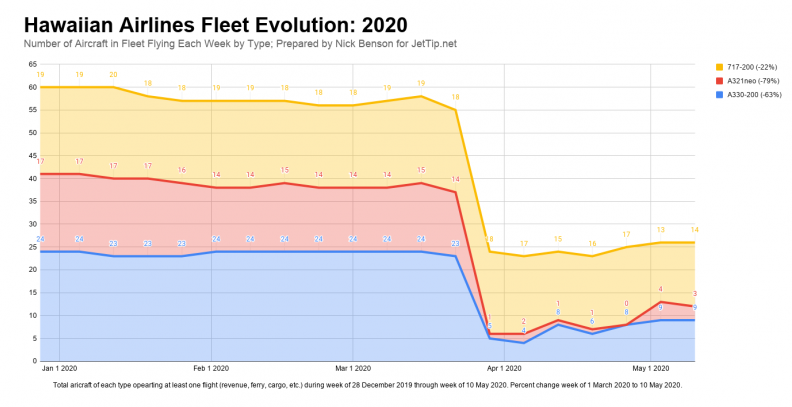

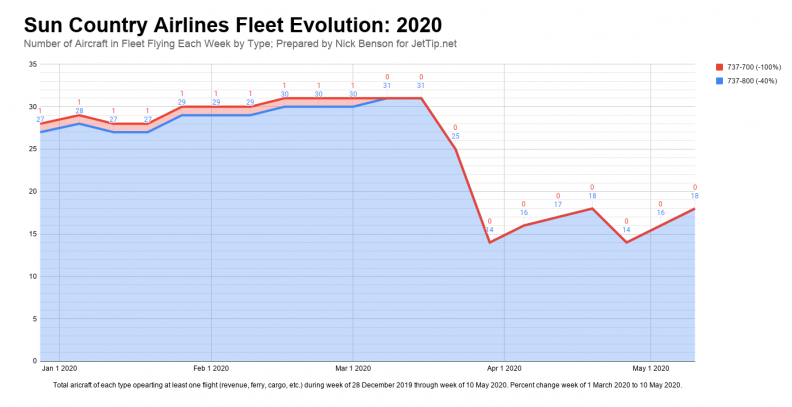

Airline Fleet Evolution

Continuing the work I originally posted on AirlineReporter a couple of weeks ago, the airlines continue to make some fleet adjustments. Notable changes this week include decreases of Delta's A321, 737-900ER, and 757-200; American's increase of 787-9; United's decrease of A320, 737-800, 737-900ER, increase of 787-9 and 777-200ER; Spirit swapping A320s for A320neos, and Allegiant's continued fleet growth in general. By my reckoning, the mainline fleets are down a combined 51%, with roughly 2,090 aircraft grounded last week, compared to 1,975 that actually flew.

Nick Benson

Nick lives in Burnsville, Minnesota with his wife and three children. He grooves on railroad and aviation photography, politics, geography, weather, and LEGO. He started JetTip's smart flight alert service in 2017, and is now a full-time avgeek. He can frequently be found atop a step ladder at MSP's Aircraft Viewing Area.

Recent Posts

Boeing Yahtzee: seeing all of their airliners, 707 through 787, in motion, in 24 hours

NFL 2024 - conference championship team charter flights

NFL 2024 - divisional round team charter flights

NFL 2024 - wild card team charter flights

NFL 2024 - week 18 team charter flight schedule

News

JetTip Features, Trip Report, Special Liveries, Events, Politics, Press Releases, COVID-19

Airline

Delta, Icelanndair, Sun Country, UPS Airlines