I'm going to try doing a new post every day with the latest updates, as I think there's some interesting content coming from other folks that's popping up but getting lost as I try to keep content on a single post up to date. We'll see how it goes. Traffic stats up top, additional news down below.

Traffic Graphs

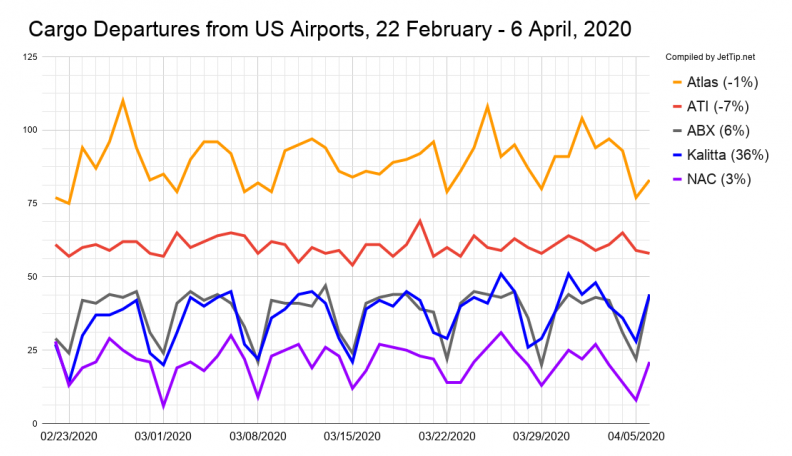

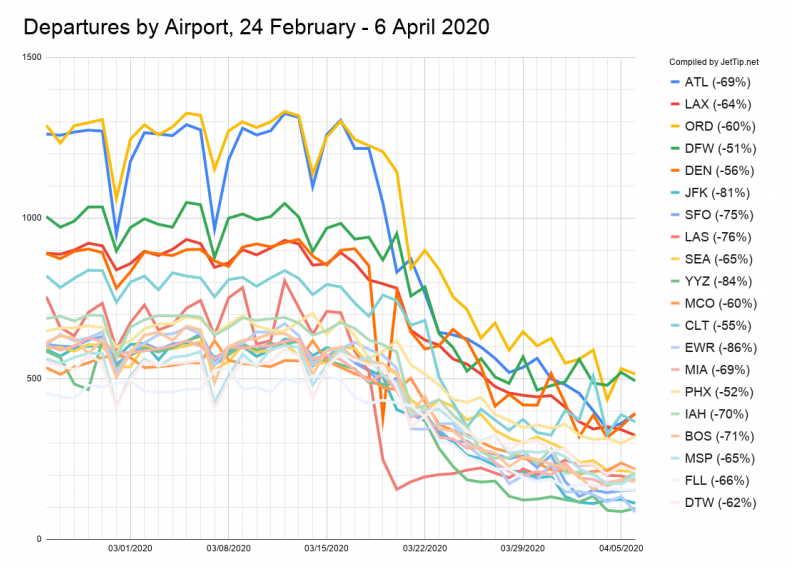

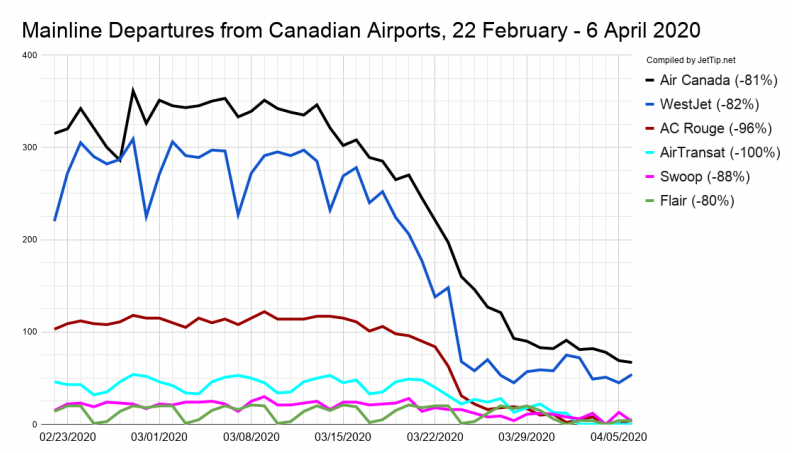

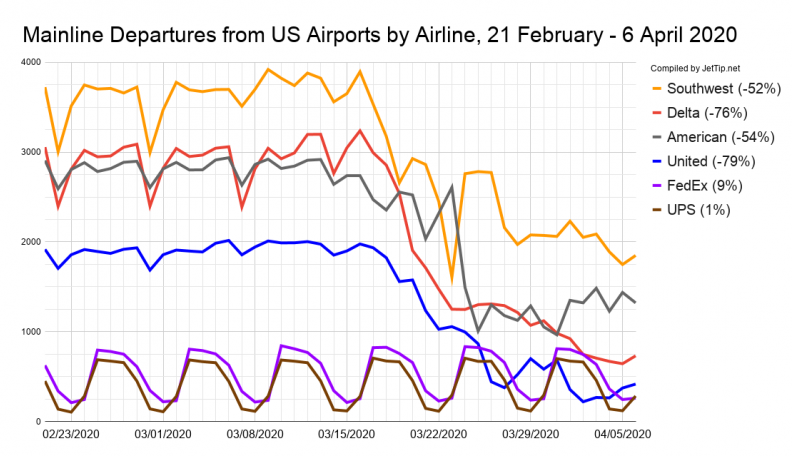

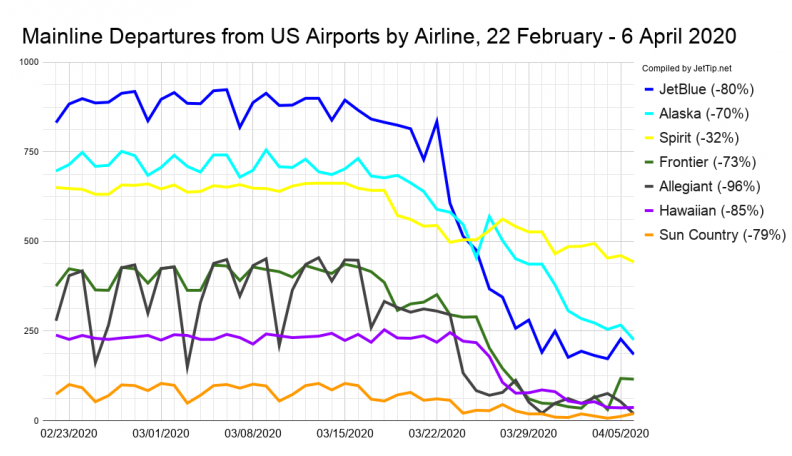

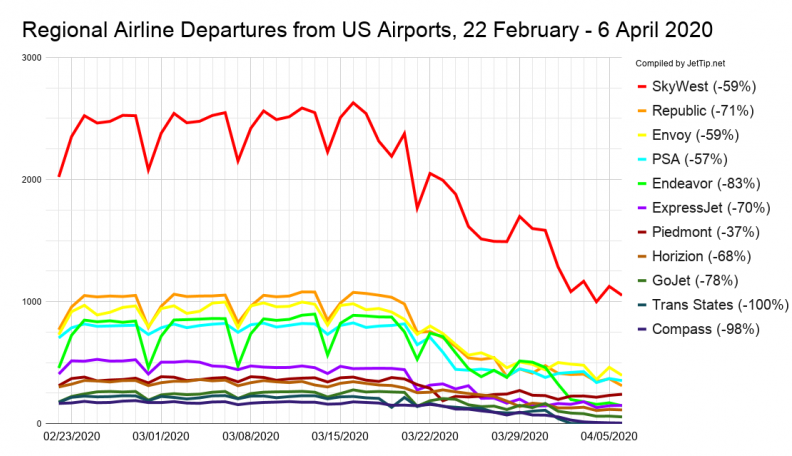

Nothing too unusual being revealed with yesterday's traffic stats; cargo flight operations are still relatively stable for the most part, with Kalitta still doing the best, and FedEx and UPS with modest increases. Passenger airline trends are steady; Spirit (-32%), Southwest (-52%), and American (-54%) appear to be outliers relative the the rest of the North American mainline carriers, who have cut much deeper. Yesterday's TSA screening stats holding steady at -95% year over year.

Methodology notes can be found at the bottom of this post.

News Updates

Most of this content can be found if you keep tabs on JetTip's Aviation News Twitter list. Nuggets today include Lufthansa's fleet reduction plans (they'll still be the only carrier operating all three families of the modern passenger quadjet), and the sobering expectations on how long a return to normal will take:

- Lufthansa Group decides on first restructuring package

- DOT adjusts, finalizes airline route requirements for CARES Act funding; Seth Miller, PaxEx.Aero

- Demand won't return until 2023; Jason Rabinowitz

- American’s To Bring Back International Flying Slowly, In Waves; Brett Snyder, CrankyFlier

- Alaska Airlines April 2020 selected US domestic service consolidations; Jim Liu, Routes Online

Additional Aviation News Resources

If you're looking to keep tabs on what's going on, there are lots of great places to be keeping track of aviation news.

- JetTip's Aviation News list with tweets from generally reliable sources

- JetTip's realtime diversion tracking page

- Coronavirus Flight Cancelation Tracker

- TSA Sreening Volume

- The Air Current

- PaxEx.Aero

- Cranky Flier's Daily Update

- Ethan Klapper's Bluer Skies

Methodology: Departures by Airline Since Late February

COVID-19 started impacting aviation in China at the end of January, which also impacted the US and Canadian routes to Asia, but large differences in the number of flights being operated by carriers on this side of the Pacific didn't really start adding up until a couple of weeks ago. A few places had been sharing global trends, but I was selfishly interested in an airline by airline breakdown of how significant the impact had been.

So, here are some graphs and an airline by airline breakdown in the decrease in traffic from US and Canadian airlines over the last month. The methodology here is to count all flights between 12:00:00 AM and 11:59:59 PM eastern time that departed from an airport in the airline's respective home country (Delta departures from US airports, WestJet departures from Canadian airports, etc.). Since commercial airline schedules are highly cyclical, the percent change is derived by comparing the specified day's count compared to the average of the number of flights each airline operated during three previous "pre-crisis" weeks, 22 February - 13 March.

Nick Benson

Nick lives in Burnsville, Minnesota with his wife and three children. He grooves on railroad and aviation photography, politics, geography, weather, and LEGO. He started JetTip's smart flight alert service in 2017, and is now a full-time avgeek. He can frequently be found atop a step ladder at MSP's Aircraft Viewing Area.

Recent Posts

Boeing Yahtzee: seeing all of their airliners, 707 through 787, in motion, in 24 hours

NFL 2024 - conference championship team charter flights

NFL 2024 - divisional round team charter flights

NFL 2024 - wild card team charter flights

NFL 2024 - week 18 team charter flight schedule

News

JetTip Features, Trip Report, Special Liveries, Events, Politics, Press Releases, COVID-19

Airline

Delta, Icelanndair, Sun Country, UPS Airlines