Traffic Graphs

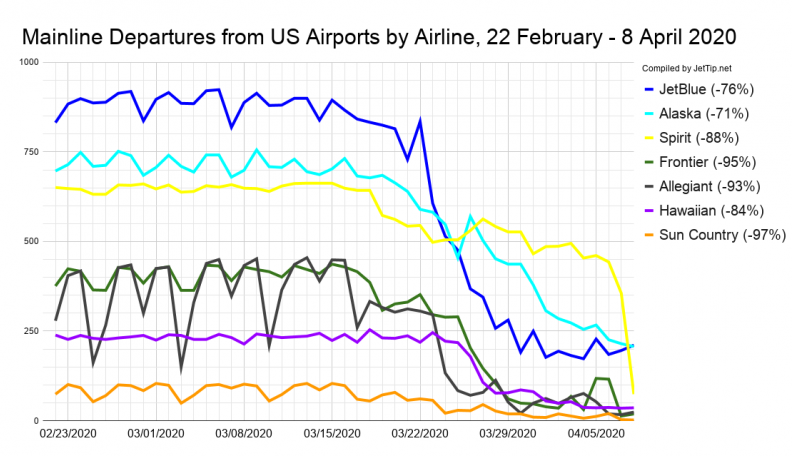

The big story from yesterday's airline data here in the US is that Spirit has implemented big cuts that get their stats inline with most of the rest of the industry - their aircraft flew 74 flights yesterday (compared to 443 a couple of days ago, or 642 on recent pre-crisis Wednesdays), and I believe several of those were ferry flights to storage.

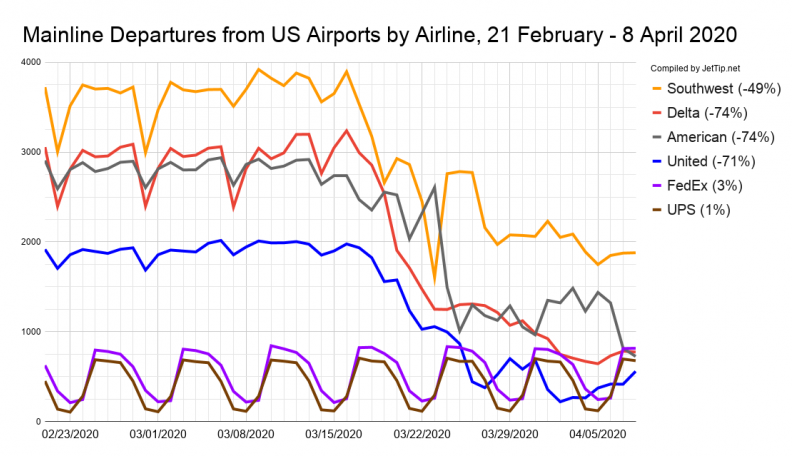

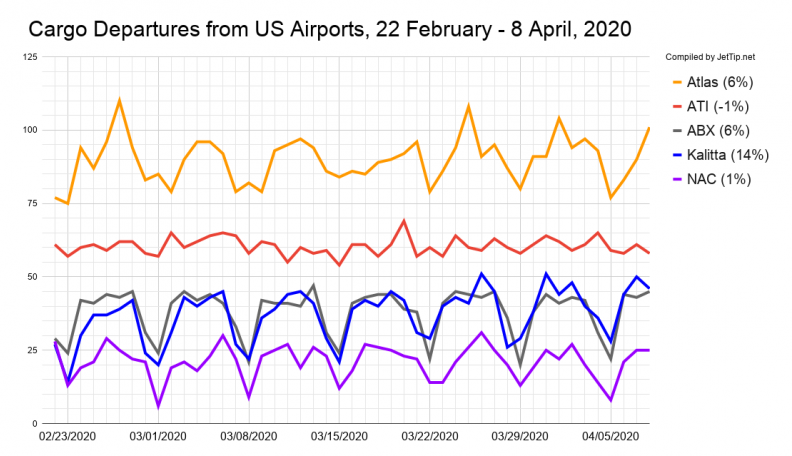

FedEx operated more mainline flights out of the US yesterday than mainline American, Delta, or United - the first time that's happened since COVID-19 started impacting traffic here.

Southwest is the next airline to monitor for a big operational adjustment; I'm not sure how they can keep operating ~50% of their flights when every other domestic mainline carrier has cut 70-95%; that said, Routes Online just posted a piece saying SWA is committed to the current service level.

TSA's numbers were sub-100,000 for the second day in a row, and represents the largest year over year percentage decline (-96%) we've seen.

Methodology notes can be found at the bottom of this post.

News from Elsewhere

- Alaska, JetBlue Get Creative to Satisfy Government Stimulus Requirements; Brett Snyder, Cranky Flier

- The airplanes that have survived the aviation apocalypse; Courtney Miller, The Air Current

- Changes in airport traffic ranks (yesterday's post)

- American's new Cargo map; Jason Rabinowitz

- How much more can US airlines cut? Seth Miller

- Cargo prices skyrocketing as companies and the federal government rush medical supplies to the US; Geneva Sands & Pamela Boykoff, CNN

Additional Aviation News Resources

If you're looking to keep tabs on what's going on, there are lots of great places to be keeping track of aviation news.

- JetTip's Aviation News list with tweets from generally reliable sources

- JetTip's realtime diversion tracking page

- Coronavirus Flight Cancelation Tracker

- TSA Sreening Volume

- The Air Current

- PaxEx.Aero

- Cranky Flier's Daily Update

- Ethan Klapper's Bluer Skies

Methodology: Departures by Airline Since Late February

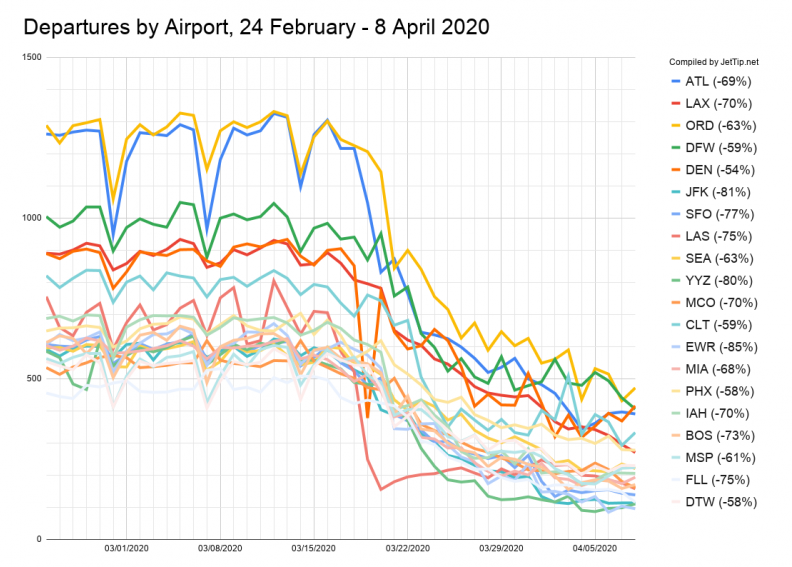

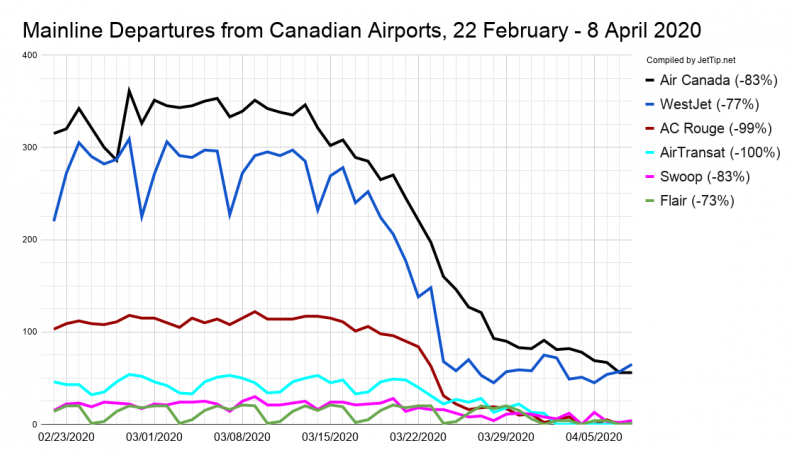

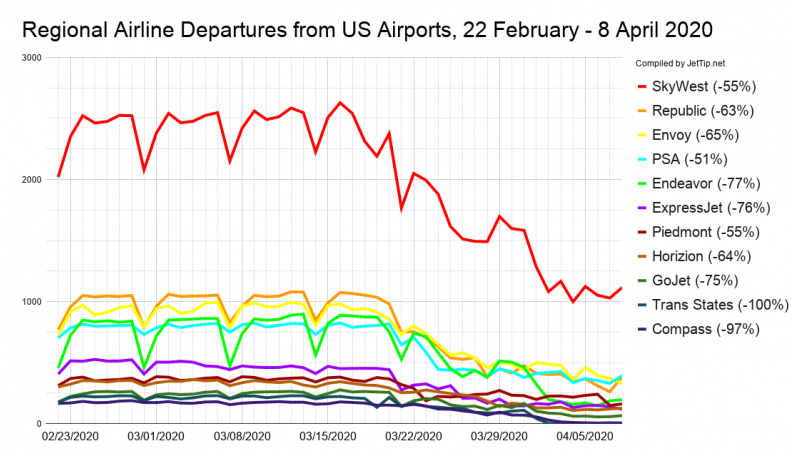

COVID-19 started impacting aviation in China at the end of January, which also impacted the US and Canadian routes to Asia, but large differences in the number of flights being operated by carriers on this side of the Pacific didn't really start adding up until a couple of weeks ago. A few places had been sharing global trends, but I was selfishly interested in an airline by airline breakdown of how significant the impact had been.

So, here are some graphs and an airline by airline breakdown in the decrease in traffic from US and Canadian airlines over the last month. The methodology here is to count all flights between 12:00:00 AM and 11:59:59 PM eastern time that departed from an airport in the airline's respective home country (Delta departures from US airports, WestJet departures from Canadian airports, etc.). Since commercial airline schedules are highly cyclical, the percent change is derived by comparing the specified day's count compared to the average of the number of flights each airline operated during three previous "pre-crisis" weeks, 22 February - 13 March.

Nick Benson

Nick lives in Burnsville, Minnesota with his wife and three children. He grooves on railroad and aviation photography, politics, geography, weather, and LEGO. He started JetTip's smart flight alert service in 2017, and is now a full-time avgeek. He can frequently be found atop a step ladder at MSP's Aircraft Viewing Area.

Recent Posts

Boeing Yahtzee: seeing all of their airliners, 707 through 787, in motion, in 24 hours

NFL 2024 - conference championship team charter flights

NFL 2024 - divisional round team charter flights

NFL 2024 - wild card team charter flights

NFL 2024 - week 18 team charter flight schedule

News

JetTip Features, Trip Report, Special Liveries, Events, Politics, Press Releases, COVID-19

Airline

Delta, Icelanndair, Sun Country, UPS Airlines